What is Aftcasting?

Luck is the second-most important factor for retirement planning; second only to withdrawal rate. Good luck can give you lifelong income, bad luck can deplete your portfolio very fast. It creates the perils of the sequence of returns and the sequence of inflation.

How can you visualize luck? This is where aftcasting comes in.

Aftcasting

uses the actual market history, including growth rate and inflation, as they

exactly happened in history.

To help you with your planning, I have three tools for you: 1. My aftcast retirement calculator (ORC), 2. My book, "Unveiling the Retirement Myth", 3. My courses.

1. Otar Retirement Calculator (ORC):

Free trial: Click here to download. It has everything except the current age is fixed at 55.

2. Unveiling the Retirement Myth:

Order "Unveiling the Retirement Myth", my 525-page book about retirement income planning based on non-Gaussian philosophy, including numerous worked examples. The paperback version is sold out; only the pdf version is available to purchase. Discussion forum: Bogleheads. A comprehensive review by Steve Thorpe. You can also order the kindle version at Amazon

3. Advanced Retirement Income Planning:

Click here to take my course for 2 hours of CE credits. You can also order the kindle and paperback version at Amazon.

My Philosophy:

While I agree whole-heartedly that past performance does not necessarily indicate future performance, designing a retirement plan that includes the black swan situations of the past, can prepare you better for a successful retirement.

I developed this model when I was writing my book "High Expectations and False Dreams - One Hundred Years of Market History Applied to Retirement Planning". My philosophy was very simple: Why guess? Why gamble? Why not use the actual, unadulterated historic market data?

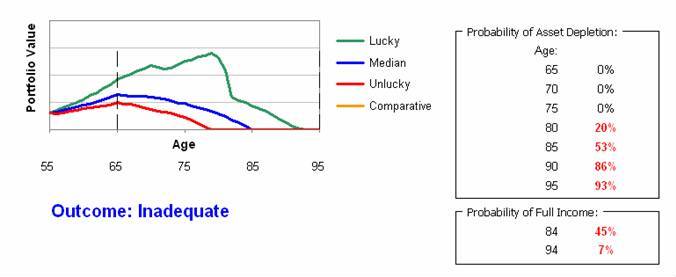

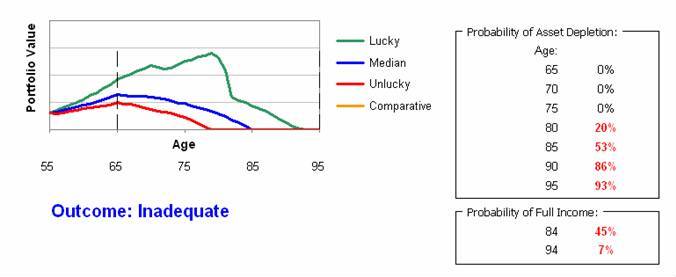

Neither the standard retirement calculator, nor the Monte Carlo simulation can account for the Time Value of Fluctuations. The Otar Retirement Calculator does! The Otar Retirement Calculator is based on actual market data. There are no assumptions of average growth or inflation. It gives you a range of portfolio asset projections that enables you to plan realistically for your retirement. When you enter your personal financial data, the model calculates asset values and cash flow streams as if you retired in each of the years since 1900. The actual historic market data is applied to your specific financial situation. The results are summarized in this chart:

The table indicates the probability of portfolio depletion, as well as the outcome:

Income Carpet and Stress Test:

You can do a stress test on the income carpet and observe its effects:

Asset Allocation Optimizer and Scenario Analysis:

All you have to do is click on the "Optimize" button and seconds later, it is all in front of you. You don't have to drop names of Nobel Prize winners and explain mysterious concepts like "efficient frontier". This optimization process will tell you exactly what the optimum equity/fixed income asset mix should be based on actual market history and the client's own cash flow picture: The lowest probability of depletion, the longest portfolio life, the largest residual amount of money in the portfolio. All by one click!

What you need to run the program?

The Otar Retirement Calculator is built on Microsoft Excel spreadsheet on a PC-type computer. You need Excel 2007 or newer to run it.

©

Copyright 2001-2024 Retirementoptimizer.com Inc. All Rights Reserved.

You may not modify, copy, reproduce, publish, upload, post, transmit,

distribute, or commercially exploit in any way any of this site content,

including code and software. Unauthorized redistribution or republication for

any purpose is strictly prohibited without the written permission of

Retirementoptimizer.com Inc.

Regulatory Declaration and Disclaimer:

The information provided here for educational purposes only. It is not intended to replace your broker, your financial planner, your tax advisor or any other professional that you currently retain, or potentially intend to hire in the future. There is no implication, expressed or otherwise, that any of my research and findings will be beneficial or helpful to your financial success. A prudent investor should read any information about investments with skepticism, including any information on these web pages. None of the information, research, comment, or anything in these web pages reflect the position, philosophy, or the investment techniques of the magazines I write for or of any other organizations that I associate with.